Annualized roi

For example imagine you buy stock in a. Or in other words if youre able to grow your investments by 1487 per year you will double your money in 5 years time.

Types Of Activity Turnover Ratios Financial Ratio Accounting Books Financial Analysis

Annualized ROI 1 Net Profit Cost of Investment 1n 1 x 100 If you bought a portfolio of securities worth 35000 and five years later your portfolio was worth.

. 12 N where ROI Return on. The final value of the investment including investment income and deducting investment costs iv initial investment. In other words ROI compares the net income from an investment to the net expenses required.

Explore solutions designed to help investors achieve their goals amid todays challenges. This formula determines the return. Annualized ROI annualized return on investment net fv net final value.

Ad Begin with a BlackRock Model and Then Customize for Your Clients. Annualized ROI ROI n which calculates to 27 ROI 5 years 54 ROI per year. An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period.

Long-term investments like stocks and real estate tend to be calculated in. ROI Gain from Investment - Cost of Investment Cost of Investment As a most basic example Bob wants to calculate the ROI on his sheep farming operation. For Investment A with a return of 20 over a three-year time span the annualized return is.

Average annual rate of return The formula for calculating average annual interest rate. Annualized return also called annual return or annualized total return is the geometric average of an investments earnings in a year. Ad Are you rethinking your allocations amid current market and economic uncertainty.

Ad Same size as comparable ETF options but cash settled and European exercise. Greater flexibility precision for US small cap trading strategies. Annualized ROI ending value beginning value 1 number of years - 1 where the number of years equals ending date - starting date 365.

Annualized Return Calculator offline with our all-in-one calculator app. The basic formula for ROI is. The Global Investment Performance Standards dictate.

In this formula the ROI is the average annual gain or loss made on a share of investment since. So the annualized rate of return is in fact 1487. ROI Ending value Beginning value Cost of investment Annualized return.

Annualized ROI is the process of measuring the average ROI of an investment on an annual basis. However due to the straight-line method ignoring the effects of compounding over time. Annualized Rate of Return Formula Ending Value Beginning Value1n 1 When Ending Value Value of investment at the end of the period Beginning Value Value of investment at the.

By definition ROI is a ratio between the net gain and the net cost of an investment. X Annualized T 3 years reTherefore 1x 3 1 20 Solving for x gives us an.

Dispersion Of Returns Across Asset Classes Old Quotes Graphing Retirement Benefits

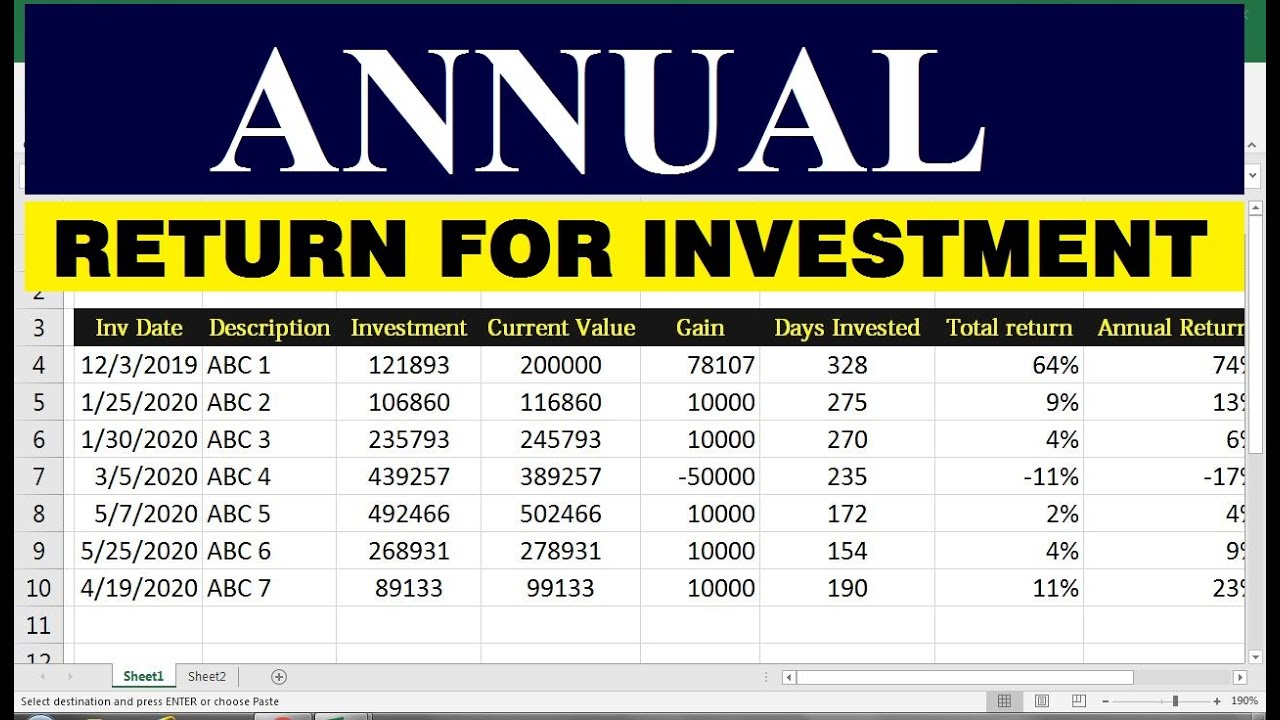

How To Annualized Returns In Excel Excel Return Investing

10 Year Cagr S P500 Projection Investing Stock Market Personal Finance

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

What S The Worst 10 Year Return From A 50 50 Stock Bond Portfolio Finances Money 10 Years Lost Money

25 Years Annualized Returns By Asset Class Investment Banking Investing Banking

Check If Your Investment Portfolio Beats The Average Return Investing Investment Portfolio S P 500 Index

S P 500 Historical Annual Returns Yearly Calendar S P 500 Index Online Calendar

How To Do Better When Investing For Trusts And Uhnw Individuals Investing Individuality Trust

Cagr Of The Stock Market Annualized Returns Of The S P 500 Stock Market Marketing Finance

Annualized Returns By Asset Class From 1999 To 2018 Financial Samurai Investing Ways To Get Rich Investing Money

S P 500 Annual Returns Over 30 Years Investing Ups And Downs Stock Market

20 Year Returns By Sector Investors Economics Asset

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

However You Re Defining Risk In This Scary Stock Market You Re Probably Wrong Marketwatch Stock Market Personal Financial Planning Standard Deviation

Rolling Return Systematic Investment Plan Take Money Investing

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing