52+ charitable remainder trust tax deduction calculator

Please click the button below to open the calculator. Enter the amount of cash or the fair market value FMV of the assets used to fund the CGA.

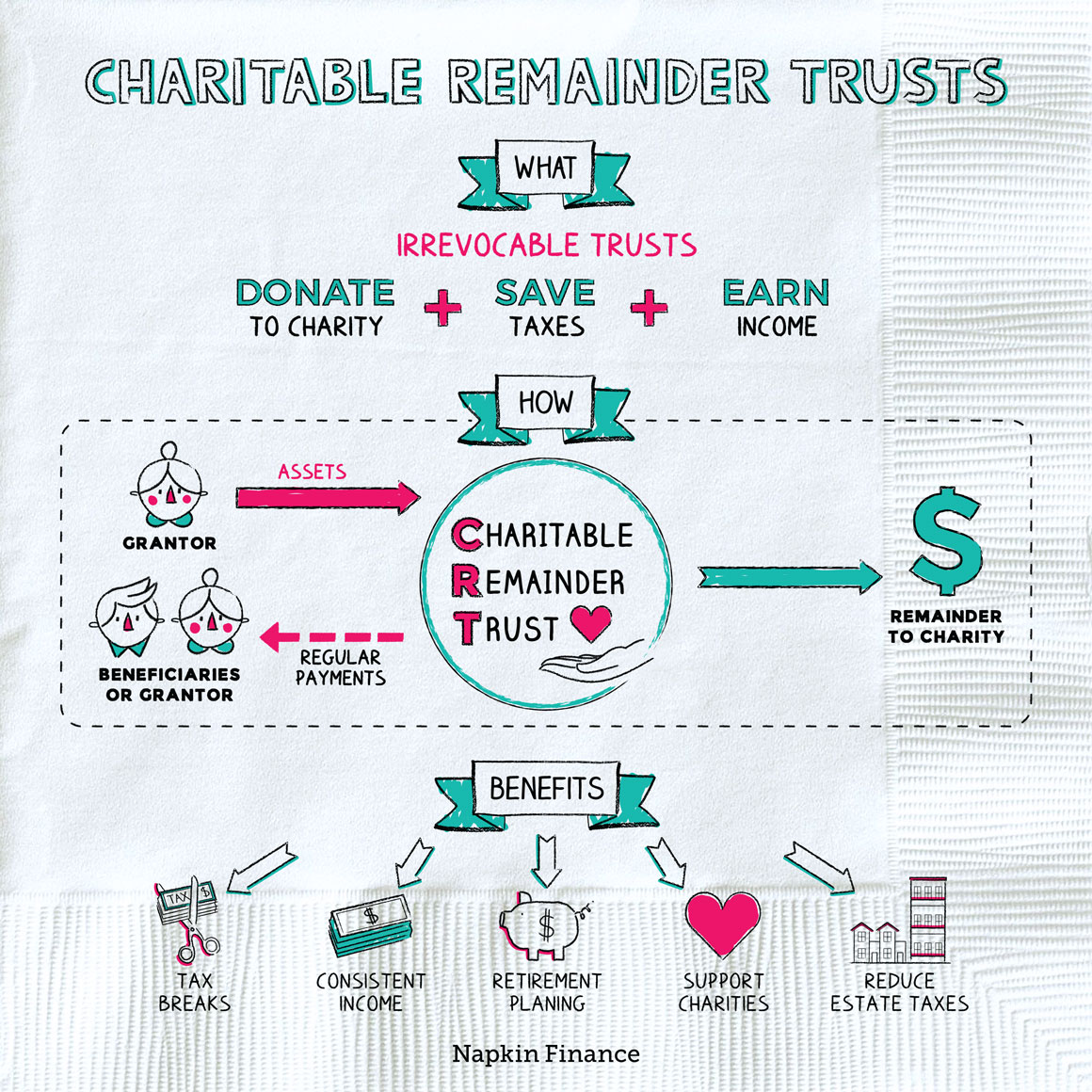

Is A Charitable Remainder Trust Right For You Napkin Finance

The deduction is limited to the present value of the charitable organizations.

. Get started to see how you can save. How long the trust is expected to. Web To calculate the charitable deduction.

Web Contributions to a charitable remainder trust qualify for a partial charitable deduction. For assets such as real estate closely-held stock and other hard. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Web Trust Amount. Voting is open through February 28 for AACR President Board. Web Charitable Remainder Unitrust Calculator.

Web Charitable Remainder Annuity Trust Calculator. Wills Trusts and Annuities. Web This charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift.

Web Charitable Tax Benefit Calculator. Web Charitable Remainder Trust Gift Calculator - American Association for Cancer Research AACR AACR Members. The federal and some state and local income tax laws in the US.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web To qualify you for your CRUT tax deduction we calculate the amount you expect to donate at the end of your trust which is based on three things. Web The calculator below determines the charitable deduction for any of the following gift types.

Web You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid for the gift annuity. First cross-reference the IRS Section 7520 rate in the month you create the trust lets say August 2022 so 38 and. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Contact your Charitable Estate Planning. The potential tax savings are calculated depending on the. Offer significant financial incentives for taxpayers to donate cash or other.

Web The Charitable Giving Tax Savings Calculator demonstrates how you could save on taxes and give more to the causes you care most about. Taxes Can Be Complex. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

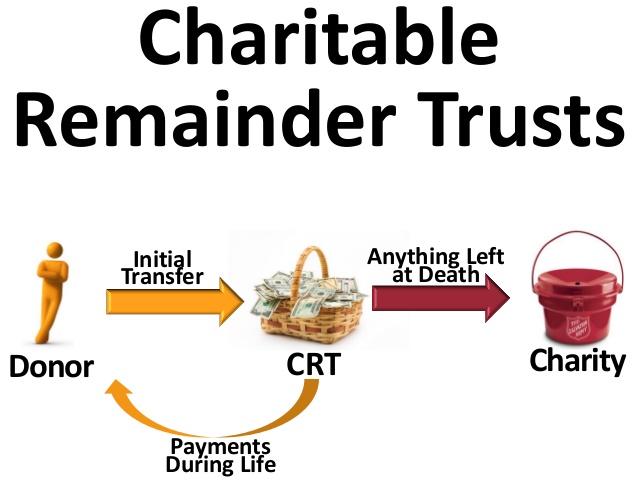

What Is A Charitable Remainder Trust Baron Law Llc

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Remainder Trust Calculator Crt Calculator

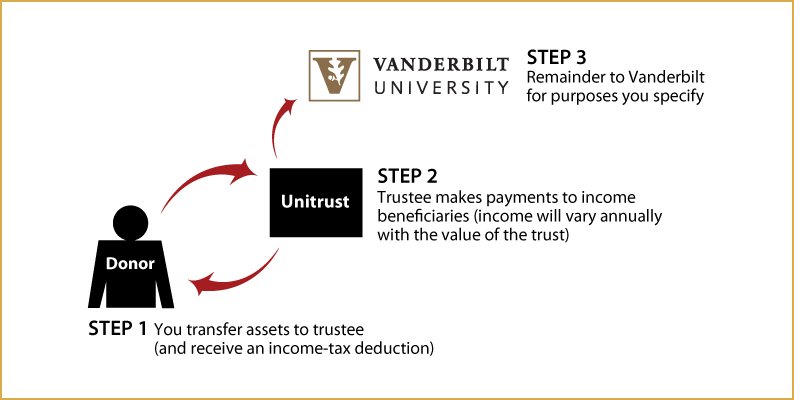

Vanderbilt University Planned Giving Charitable Remainder Unitrust

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

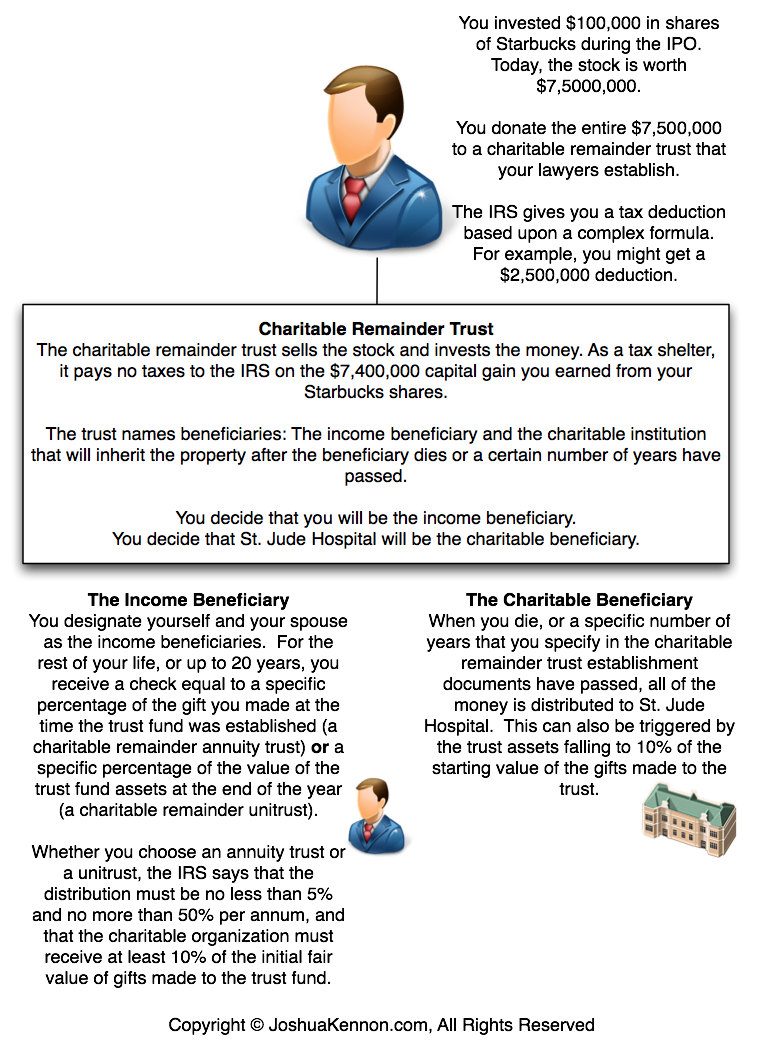

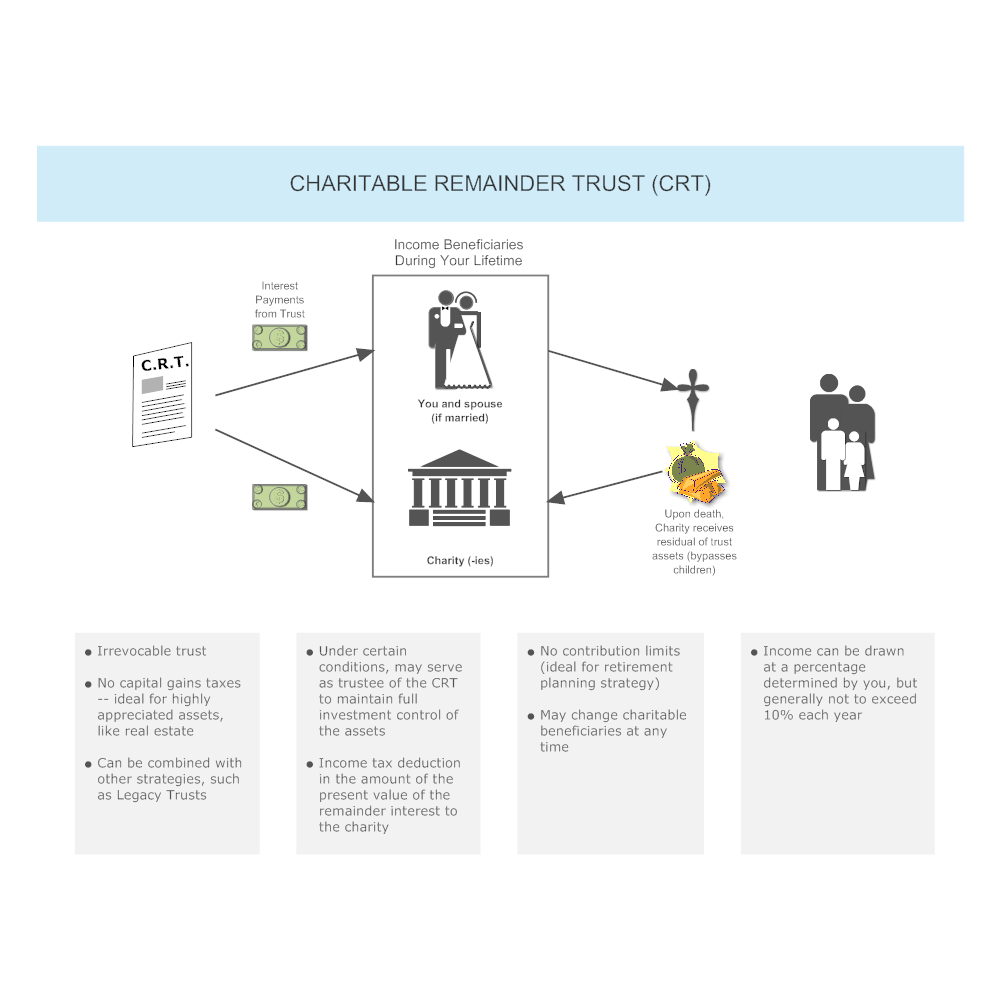

Charitable Remainder Trusts For Beginners

Another Frame Taxation

Income Tax Accounting For Trusts And Estates

Charitable Remainder Trust Gift Calculator American Association For Cancer Research Aacr

Web Designer Issue 262 2017

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

How To Give To Charity In The Most Tax Effective Way

Charitable Remainder Trusts Combining Lifetime Income And Philanthropy Glenmede

Sofla Rappers Sentenced For Roles In Tax Fraud 6 Men Face A Combined 52 Years In Jail And Nearly 30 Million In Restitution Don T Mess With Taxes

Charitable Remainder Trust Crt

Autologous Bone Marrow Transplantation Blog Science Connections